Definition and Key Components of a Smart Contract

Definition

A smart contract is a self-executing contract where the terms of the agreement between the buyer and the seller are directly written into code. These contracts are stored and replicated on the blockchain network and supervised by the network of computers that run the blockchain.

Key Components

Smart contracts typically consist of the following components:

- Agreement Terms: Clearly defined rules and obligations are encoded within the contract.

- Triggering Events: Specific conditions that need to be met for the contract to be executed.

- Execution Environment: The blockchain network where the contract resides, offering security, transparency, and immutability.

The Role of Smart Contracts in Cryptocurrency Transactions

Smart contracts are redefining the way transactions are conducted in the world of cryptocurrency. Here’s a look at their significant roles:

- Automation: By automating transactions, smart contracts reduce the need for intermediaries, decreasing costs, and enhancing efficiency.

- Trust Building: Since they are tamper-proof and transparent, they instill confidence in the parties involved.

- Flexibility and Customization: They can be tailor-made to suit various types of transactions, providing tremendous adaptability.

Popular Platforms for Developing Smart Contracts

Several platforms support the development of smart contracts. Among them, the most renowned include:

- Ethereum: Widely recognized as the pioneer platform for smart contract development, Ethereum provides a robust and flexible environment.

- Binance Smart Chain: Known for its high performance and scalability, Binance Smart Chain has emerged as a popular choice for developers.

- Cardano: Cardano stands out for its scientific approach and strong emphasis on sustainability, making it an attractive option for smart contract development.

- Solana: Solana is gaining attention for its high throughput and low transaction costs, characteristics that make it suitable for large-scale applications.

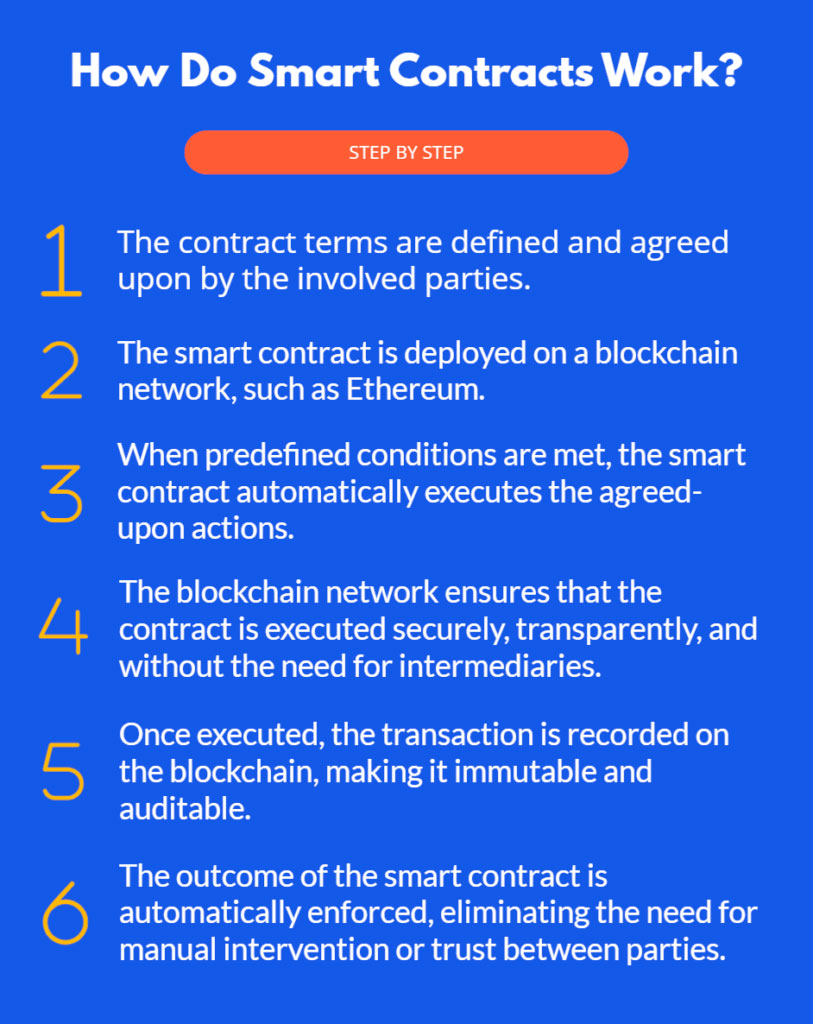

How Smart Contracts Execute Agreements: A Technical Overview

Understanding the execution of smart contracts involves delving into the technical details:

- Encoding: The agreement’s terms and conditions are converted into a programmable code, utilizing languages like Solidity or Vyper.

- Deployment: Once developed, the smart contract is deployed onto the blockchain network, where it becomes immutable and publicly verifiable.

- Activation: The smart contract awaits the triggering event to activate its execution. This might involve a user initiating a transaction or a certain date being reached.

- Verification: The network nodes validate the conditions and authenticate the transaction. Any discrepancies or issues lead to automatic rejection.

- Execution: If all conditions are satisfied, the contract is executed. The predefined actions are carried out, and the appropriate transfers or changes to the blockchain are made.

Advantages of Using Smart Contracts in Cryptocurrencies

Smart contracts offer numerous advantages in the sphere of cryptocurrencies, transforming traditional practices:

- Efficiency and Speed: Smart contracts automate and streamline processes, eliminating the need for intermediaries, which significantly accelerates transactions.

- Transparency and Trust: With all terms visible on the blockchain and transactions tamper-proof, both parties can conduct business with full confidence and transparency.

- Cost Reduction: The absence of third-party mediation reduces overall costs, making transactions more affordable.

- Global Reach: Being decentralized, smart contracts enable global participation without the hindrance of geographical or jurisdictional barriers.

Risks, Security Concerns, and Challenges

Though promising, smart contracts are not without risks and challenges:

- Security Vulnerabilities: Coding errors and bugs can lead to security breaches, making contracts susceptible to attacks.

- Legal and Compliance Risks: Lack of clear legal frameworks can result in compliance issues and legal uncertainties.

- Technological Limitations: Interoperability and scalability can pose challenges, affecting widespread adoption and usage.

Real-world Examples and Use Cases in Cryptocurrency

Smart contracts find applications across various industries:

- Decentralized Finance (DeFi): They enable decentralized borrowing, lending, and asset management, reducing reliance on traditional banking systems.

- Supply Chain Management: Cryptocurrencies utilize smart contracts to facilitate transparent, secure, and efficient supply chain operations.

- Tokenization and Asset Management: Smart contracts make tokenizing assets and managing digital tokens more seamless and accountable.

The Regulatory Landscape and Legal Considerations

Navigating the legalities of smart contracts requires attention to emerging regulations:

- Jurisdictional Considerations: Different jurisdictions have varying regulatory stances, and understanding these is crucial for compliance.

- Legal Framework Development: Countries are gradually developing legal frameworks to accommodate and regulate smart contracts, reflecting their growing significance.

- Challenges in Enforcement: Enforcing legal rights and obligations in decentralized systems presents unique challenges that must be carefully considered.

The Future of Smart Contracts in Cryptocurrency

Smart contracts in cryptocurrency are undoubtedly revolutionizing various aspects of the digital economy. From automating complex processes to fostering trust and reducing costs, they offer vast potential. Yet, it is imperative to approach with caution, acknowledging the risks and legal complexities involved.

With ongoing technological advancements and evolving regulatory landscapes, the future appears bright for smart contracts. As more real-world applications emerge and the technology becomes more refined and secure, smart contracts could become an integral part of not just the cryptocurrency ecosystem but various industry sectors worldwide.

In the continually changing world of technology, adaptability and innovation will shape the future. Smart contracts stand as a testament to human ingenuity and the relentless pursuit of more efficient, transparent, and inclusive financial systems. Whether they become the norm or remain a niche technology, their impact on the world of cryptocurrency and beyond is undeniable and will be felt for generations to come.

IronWallet Mobile: Comfortable and Reliable Crypto Wallet

The landscape of cryptocurrency is filled with various tools and platforms to manage digital assets. Among these, non-custodial cryptocurrency wallets play a crucial role. This article takes an in-depth look into non-custodial wallets available on smartphone applications, with a particular focus on IronWallet.

The world of non-custodial cryptocurrency wallets is rich with options, especially in the smartphone application market. Notable offerings include Electrum, Mycelium, Exodus, Trust Wallet, MetaMask, Ledger Live, Trezor Suite, and IronWallet. Of these, IronWallet stands out as a recommendation, warranting further exploration.

IronWallet: A Closer Look

The question often arises as to which solution to utilize for the secure storage of crypto-assets, coupled with convenient use. In this scenario, IronWallet’s mobile non-custodial cryptocurrency wallet appears as an unambiguous recommendation.

- Versatility Across Platforms: IronWallet is designed to function seamlessly on both Android and iOS platforms, providing flexibility for users across different devices.

- Secure Storage: Incorporating proven technology from standard Android or iOS devices, IronWallet ensures the secure storage of private keys and seed phrases on the user’s device. It further enhances security through double key encryption.

- Transaction Security: Similar to hardware cold wallets, IronWallet ensures that the private key is utilized only during the process of signing a transaction.

- Enhanced Protection: Users have the option to set up biometric protection, adding an extra layer of security to the wallet.

- Multicurrency Support: The wallet is not limited to one or two cryptocurrencies. It supports more than 1000 cryptocurrencies, with the list continuously growing with each update.

- User Experience Features: IronWallet enriches user experience with 20 supported interface languages.

- Comprehensive Asset Management: Users have access to full transaction histories, the creation of multiple wallets for different purposes, saving public addresses of interactions, and checking exchange rates without exiting the app.

- Innovative Functions: Utilizing dApps and Walletconnect, offering easy backup options, and providing choices in currency displays, IronWallet stays ahead in innovation.

- Customization and Support: Users can personalize the list of tracked cryptocurrencies, and 24/7 user support ensures assistance whenever needed. The wallet also offers functionalities for managing suspended transactions in the Ethereum network.

- Unique Technological Developments: The IronWallet team continues to innovate, developing a technology to send TRC20 tokens in the Tron network cheaper and with the network fee paid from the sent token. Efforts are also being made to reduce the network commission for this technology and to extend such transactions to other blockchain networks.

In summary, IronWallet is a comprehensive, versatile, and secure non-custodial cryptocurrency wallet that serves a wide range of user needs. The continual innovation and commitment to security make it an appealing choice for those looking to manage their digital assets effectively. The capabilities it offers, from multilingual support to advanced encryption techniques, underscore a broader trend of innovation in the field of cryptocurrency management, mirroring the dynamic nature of the technology itself.