Uncomfortable golden pillow

The disappointing golden cushion

Bitcoin has hit record highs, so US residents are hoping to get more of it. Let’s take a look at how gold and Bitcoin owners are adapting to changing conditions, and find out which countries are the easiest to buy precious metals in.

Irreversible changes

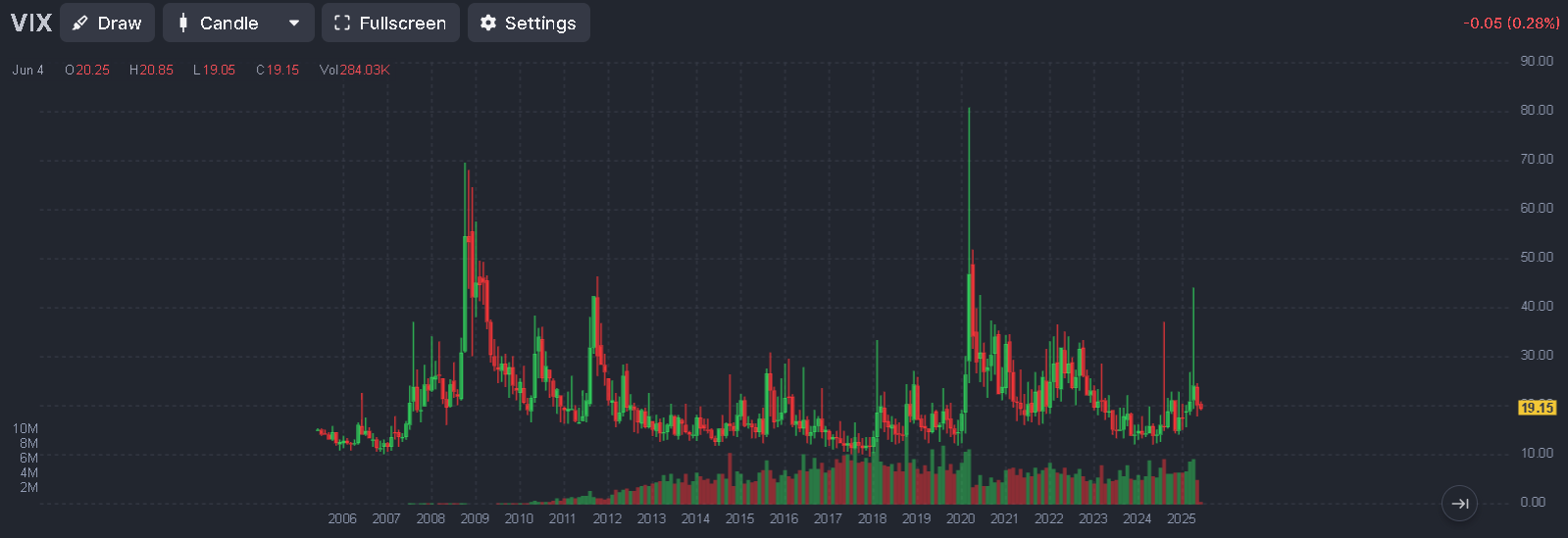

In the last ten years, the Volatility Index (also called the Volatility Index or VIX) has been read eight times at levels that show panic in the market. The index reached its peak during the pandemic, with 80 points, which is more than the 2008 crisis. The fear index shows how volatile the S&P 500 stock market is expected to be, and it’s based on options trading on the Chicago Board Options Exchange, or CBOE for short. It helps you see how the market value of big international companies can go up and down.

If you look at the VIX index chart from 2006 to 2025, you’ll see that a reading above 20 is considered ‘exciting’ and above 30 is considered ‘alarming.’ This data comes from the Finviz analytical platform.

At the same time, the US dollar index is also sending some pretty worrying signals. The changes in the chart since late 2022 are looking more and more like the start of a global slump similar to that seen in 2008.

The current situation does not promote investor confidence. Actually, it shows how the global financial system is going to change. Debt obligations, which have always been seen as a safe bet in a falling stock market, are now facing some tough challenges. But they’re still in the investment portfolios of a lot of the big players, and they’re used as collateral for stablecoins like USDT. Since 2021, these financial instruments haven’t been able to reverse the bearish trend.

With all these worrying signs, and with all the political and economic changes happening around the world, experts are increasingly writing about different ways to keep your money safe, reminding us of the importance of investing in precious metals and digital assets.

Ray Dalio, founder of the Bridgewater hedge fund, has repeatedly reminded us: ‘If you don’t own gold, you don’t understand history or economics.’ Similar thoughts are expressed by Peter Schiff, president of Euro Pacific Capital and critic of Bitcoin, as well as investor Michael Burry, who predicted the 2008 financial crisis.

Gold in cryptocurrency

The introduction of Bitcoin into the national reserve funds of many countries has become an important event, setting new directions in the global financial system. The main question is whether the dollar will retain its role in this system and how the monetary system will change in five years. More and more small companies are starting to add Bitcoin to their investment portfolios. Every week, there are reports of new steps in this trend. The first cryptocurrency doesn’t just set its own standards, it pulls altcoins along with it too, making it an instrument of both economic and political speculation. The connection with traditional finance is now really strong – just look at how the crypto market reacted to stuff like Donald Trump’s talks or the results of the Federal Reserve’s work.

In a volatile environment, where the price of Bitcoin varies from approximately 50,000 to 250,000, there is a need for an alternative for the next five to ten years. In this context, gold is once again coming to the fore. Every day, the need to convert Bitcoin into gold is growing. While major banks are opening up the possibility of buying Bitcoin, Americans are willing to exchange their reserves of this precious metal for cryptocurrency.

According to a recent survey, four out of five Americans expressed a willingness to convert part of the gold owned by the state into Bitcoin. A study conducted by The Nakamoto Project among 3,345 respondents showed that most of them would prefer to convert up to 30% of their reserves, while the average share they agree to is 10%. Young people under the age of 35 are particularly interested in owning the first cryptocurrency.

The merger of ‘digital’ and ‘traditional’ gold

In recent years, crypto companies have been actively buying up bitcoins, although other organisations are still far from Strategy’s achievements. For example, Michael Saylor’s firm owns more than 580,250 BTC, while its closest rival, Miner MARA, controls around 49,230 BTC. Metaplanet rounds out the top three with 8,888 BTC.

Meanwhile, central banks in various countries continue to increase their gold reserves annually. In 2024, they replenished their reserves by 1,045 tonnes, in 2023 by 1,037 tonnes, and a record level was reached in 2022, when 1,082 tonnes were purchased. Uzbekistan, China and Kazakhstan are the leaders in this regard.

The pace at which this process is taking place may indicate that a number of countries are preparing for changes in the global economy. Jim Rickards, a former advisor to the CIA and the Pentagon, describes gold held outside a country as ‘paper gold.’ According to him, in times of economic crisis, government agencies can freeze or seize such reserves. HThere have been times when countries have tried to return their reserves, but these attempts haven’t always worked out.

Back in the 1960s, the French President Charles de Gaulle got the US to let him have 3,313 tonnes of gold, which played a big part in getting the dollar to stop being convertible into gold in 1971. India had a crisis in 1991, so it used its gold reserves to get credit and gave 100 tonnes back to the UK in 2024. The Netherlands, Italy and Germany keep a lot of their gold in storage in other countries, including the Federal Reserve Bank of New York.

When it comes to investing in physical gold, Western countries often have to deal with high taxes and bureaucracy. But in Asia, it’s better: in India, the tax on gold is 3%, and the import duty has been cut to 6%. In China, gold sales are exempt from VAT, and in Dubai, there is no import duty on gold, although there is a 5% VAT. In Saudi Arabia, gold intended for investment is also not taxed. But in Japan, the tax on gold is 10% VAT.

Conclusion

While the crypto community is eagerly awaiting new records for Bitcoin, the Federal Reserve is still thinking about what to do next. They might be unpredictable, but Donald Trump’s aggressive economic policy is creating more chances for the VIX index to grow and global changes to speed up.The crypto market’s been known to lose up to 40% of its value in just one day. Big-time investors who put their money into long-term investments don’t really care about short-term price swings.

While large players are beefing up their portfolios during market slumps, small investors are feeling the fear. Big money’s all about selling assets in small batches at peak prices and then buying them back at lower prices, creating a vicious circle that’s made worse by constant market speculation.