Token vs Coin: What’s the Difference?

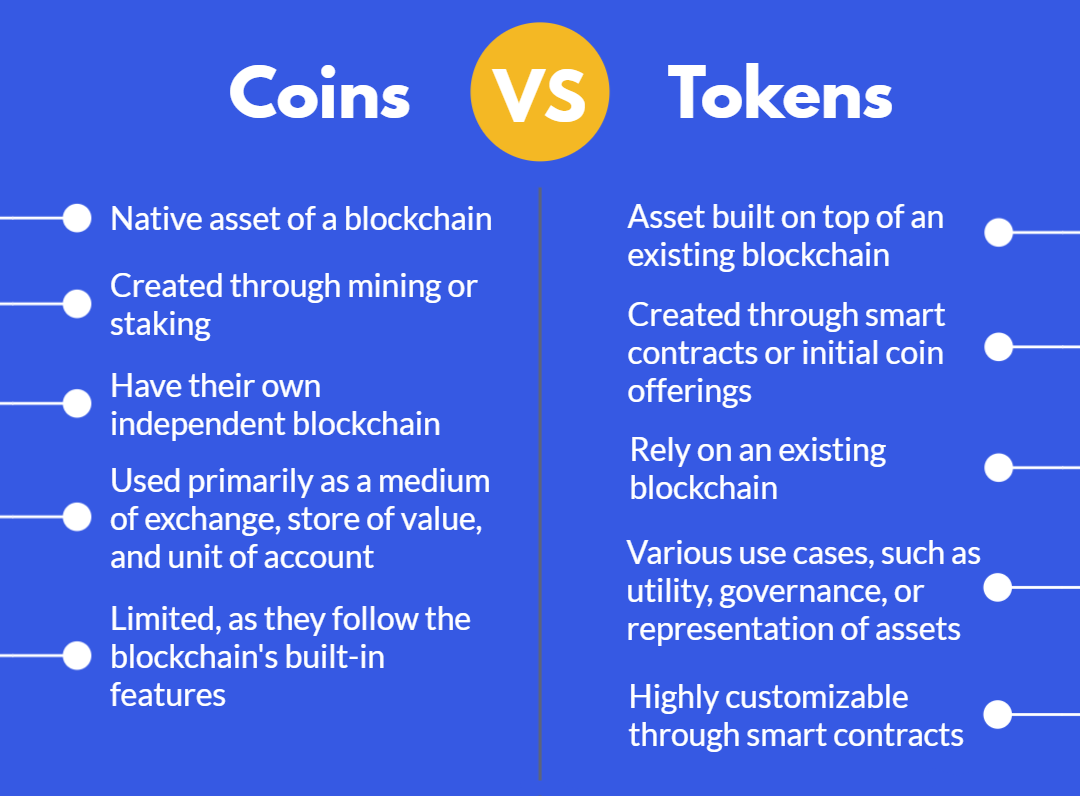

For beginners to the realm of digital money, the terms “coins” and “tokens” might appear equivalent, as if they both represent any form of virtual currency. However, crypto coins and digital tokens are distinct types of crypto assets, each possessing special traits and functions.

Comprehending the distinction between these terms is crucial for navigating the more intricate aspects of the blockchain landscape.

Understanding Coins and Tokens

What is a Crypto Token?

Tokens are electronic assets that exist on pre-existing blockchains. They do not have independent blockchains but operate on another blockchain’s infrastructure. Ethereum is a popular platform for creating digital tokens, primarily due to its smart contract capabilities. Crypto tokens created on Ethereum are referred to as ERC-20 virtual tokens.

Digital tokens are pretty versatile and offer more than just a way to pay for stuff. They often give you access to a project’s features. Take the Basic Attention Token (BAT) for example. It’s used to improve digital advertising. Advertisers buy ads with BAT tokens, and then these tokens are shared between publishers and browser users as a reward for hosting and viewing the ads.

What is a Crypto Coin?

Coins are digital resources that operate on their own blockchains, functioning independently within their networks. Examples include Bitcoin (BTC), Ethereum (ETH), and Monero (XMR). These crypto coins exist on their unique ledgers and can be sent, received, or processed within their networks.

Crypto coins share many similarities with traditional currency: they are fungible, divisible, portable, and have a finite supply. Primarily, they serve as a medium of exchange, akin to physical money. However, some virtual coins, like Ether, extend beyond mere currency they are also utilized within their blockchains to facilitate transactions.

Coins vs Tokens: Key Differences

Purpose and Function

Digital coins and crypto tokens have distinct purposes. Crypto coins, like traditional currency, are primarily used for buying, selling, and storing value. Virtual tokens, on the other hand, are designed for specific functions within a blockchain, such as representing ownership, granting access to services, or triggering actions within the network.

Creation and Issuance

Digital coins are brought into existence through a process known as mining, where individuals use their computers to verify transactions and secure the blockchain. Electronic tokens, however, are created by a project or company, often through crowdfunding methods like initial coin offerings (ICOs).

Blockchain Dependency

Crypto coins operate on their blockchains and serve as the main currency of that network. Digital tokens are built on top of existing blockchains and depend on the infrastructure and rules of that blockchain to function.

Value and Utility

Virtual coins derive their value from being used as money and from the balance of supply and demand. Crypto tokens gain their value from the specific uses or services they offer within their respective ecosystems, often linked to the success of the project or platform they belong to.

Examples of Tokens and Coins

Popular Tokens

- Shiba Inu (SHIB): Shiba Inu is a well-known meme coin on the Ethereum blockchain, acting as a utility token within the ShibaSwap ecosystem. SHIB can be used for providing liquidity, staking, and voting. Initially, there were 1 quadrillion digital tokens, but now only 500 trillion remain in circulation. The Shiba Inu ecosystem also includes LEASH and BONE crypto tokens for governance and rewards.

- Polygon (MATIC): MATIC is an ERC-20 token on the Ethereum blockchain and the native cryptocurrency for the Polygon network, a Layer 2 scaling solution. MATIC is used to pay transaction fees, incentivize users, and power dApps. Holders can stake MATIC to become validators, earn rewards, and vote on governance. MATIC also facilitates asset transfers between Ethereum and Polygon using the Polygon Bridge.

- Uniswap (UNI): UNI is an ERC-20 token on the Ethereum blockchain and the governance token for the Uniswap decentralized exchange (DEX). UNI holders can vote on proposals, earn rewards by contributing to liquidity pools, and use UNI for trading pairs and token swaps on the Uniswap platform.

Popular Coins

- Bitcoin (BTC): Bitcoin operates on its blockchain and has a limited supply, making it a popular store of value. Often referred to as “digital gold,” Bitcoin has become a preferred choice for investors looking to diversify beyond traditional stocks and bonds.

- Ether (ETH): Ether is the primary coin for the Ethereum blockchain, which also supports numerous electronic tokens. As the largest “altcoin” (alternative to Bitcoin), Ethereum attracts investors betting on its value increasing as more dApps (decentralized apps) use its blockchain.

- Litecoin (LTC): Litecoin was created as a derivative of Bitcoin and primarily serves as a store of value and a payment method.

Advantages and Disadvantages of Tokens and Coins

Tokens

Advantages:

- Versatility: Digital tokens can be designed for various purposes, from representing ownership to facilitating transactions or enabling access to services.

- Efficient fundraising: Crypto tokens can be issued through ICOs, providing projects with an effective means of raising funds and distributing their assets.

- Utility and functionality: Electronic tokens are intrinsically tied to the underlying project or platform, providing utility and functionalities specific to that ecosystem.

Disadvantages:

- Dependence on underlying platform: Digital tokens rely on the success and adoption of the project or platform they are built upon, making them vulnerable to the platform’s performance.

- Regulatory uncertainty: The regulatory landscape surrounding crypto tokens can be complex and evolving, potentially introducing compliance challenges.

- Speculative nature: Some electronic tokens may be subject to high volatility and speculation, similar to traditional securities.

Coins

Advantages:

- Decentralization: Virtual coins operate on their dedicated blockchain, promoting decentralization and reducing reliance on a single entity.

- Established use case: Crypto coins have a well-defined use case as a medium of exchange and store of value, similar to traditional currencies.

- Widespread adoption: Certain digital coins, like Bitcoin, have achieved significant adoption and recognition, contributing to their value and stability.

Disadvantages:

- Limited functionality: Virtual coins primarily serve as a medium of exchange and store of value, with limited functionalities beyond those core purposes.

- Mining complexities: The mining process for certain crypto coins can be energy-intensive and computationally demanding, raising concerns about sustainability and scalability.

- Volatility: The value of digital coins can be subject to significant volatility, influenced by market speculation and adoption rates.

Best Wallets for Storing Tokens and Coins

When it comes to storing tokens and coins, choosing a reliable and secure wallet is crucial. Among the various options available, IronWallet stands out as an innovative mobile cold wallet, providing unparalleled security and convenience for cryptocurrency users.

IronWallet is a cutting-edge mobile cryptocurrency non-custodial wallet designed to keep your digital assets safe and secure. It introduces a unique feature: the ability to record the seed phrase directly onto a physical card through the IronWallet app, which serves as a true cold wallet. This ensures secure access to your crypto assets even when your mobile device is offline.

Key Advantages of IronWallet

1. Mobile Cold Wallet Functionality:

- The integration of seed phrase recording onto a physical card offers an added layer of security, transforming your mobile device into a cold wallet.

2. Comprehensive Security Measures:

- IronWallet champions secure storage of private keys and seed phrases directly on the user’s device.

- Double key encryption ensures that the private key is retrieved and used from secure storage only during transaction signing.

- Optional biometric protection adds an extra security layer.

3. User-Friendly Mobile Application:

- Available on both Android and iOS, IronWallet supports 20 different interface languages, enhancing its global usability.

- Users can easily make cryptocurrency exchanges using decentralized exchanges directly within the app.

4. Convenient Transaction Management:

- The app provides a full view of transaction history for all assets and the ability to create multiple separate wallets without storing public interaction addresses, which protects public data.

5. Advanced Features and Customization:

- Users can check exchange rates, use dApps, and WalletConnect within the app.

- Backup options are available to ensure the safety of digital assets.

- The app allows for the customization of tracked cryptocurrency lists, displaying both freely convertible and one of the 47 national currencies.

6. Innovative Transaction Solutions:

- IronWallet has developed technology that allows TRX20 tokens to be sent on the Tron network with network fees paid in the token being sent, solving the issue of users lacking TRX for fees.

- On the Tron and Ethereum networks, sending stablecoins like PYUSD, USDT, and USDC can be done without gas fees, as commissions are charged in the same currency as the payment.

7. Customer Support:

- IronWallet offers 24/7 customer support and assistance, ensuring that users have help whenever needed.

Conclusion

Understanding the difference between crypto coins and digital tokens is essential for navigating the blockchain world. Crypto coins mainly function as digital currency, while virtual tokens can serve various purposes depending on the network and its objectives.

Digital coins like BTC and ETH operate on their blockchains, whereas crypto tokens like SHIB and UNI use Ethereum. Virtual coins typically have a limited supply and are straightforward to trade, unlike electronic tokens. Digital tokens, conversely, can have diverse roles based on their network.

Grasping these differences empowers users and investors to make informed decisions about engaging with crypto assets and blockchain projects.