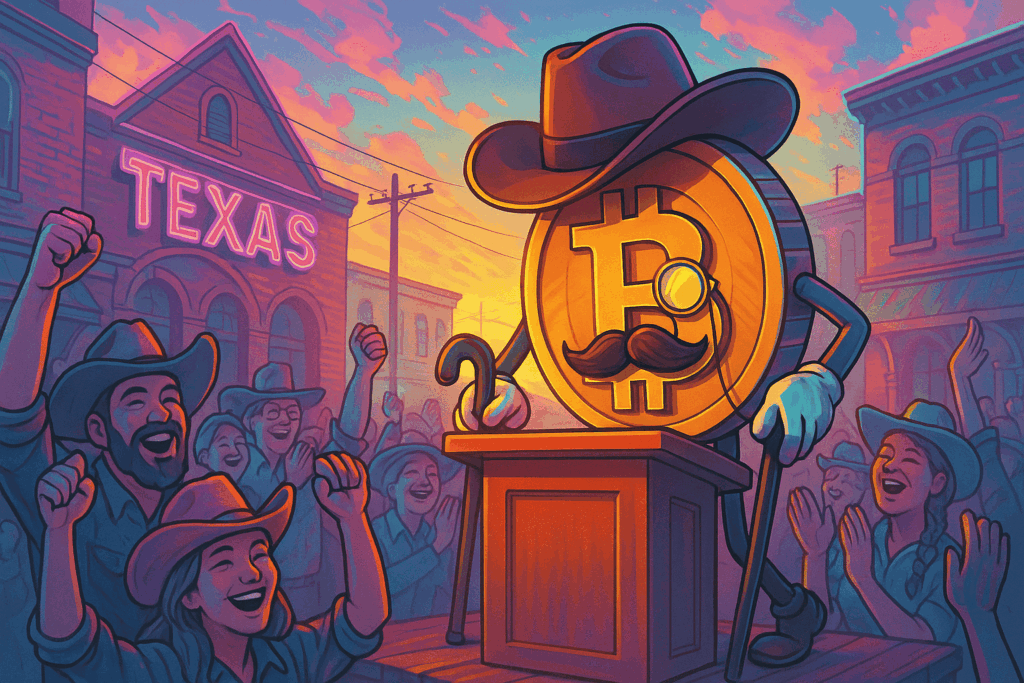

The great Texas crypto folly

So, Texas has decided to dive headfirst into cryptocurrency. Governor Greg Abbott has signed a bill creating a “Strategic Bitcoin Reserve,” a move that should set off alarm bells for anyone with a passing familiarity with economic history and common sense. The stated goals of strengthening financial resilience and hedging against inflation are the standard, almost comically predictable, justifications trotted out by crypto evangelists. But let’s be clear about what is actually happening here: the state of Texas is taking public funds and gambling them on a purely speculative asset.

The notion that Bitcoin is an asset with no intrinsic value, no income stream, and a price history that looks like a cardiogram during a panic attack, can provide “financial resilience” is magical thinking. A strategic reserve is meant to be stable. Bitcoin is the opposite of that. Its value is driven by nothing more than the belief that someone else will be willing to pay more for it later, the very definition of a speculative bubble. To call this a hedge against inflation is to ignore that its wild price swings have no reliable correlation with actual inflation data. It’s a hedge against nothing but boredom.

What’s more, this fund will be guided by an “advisory committee of three crypto investment professionals.” This isn’t oversight; it’s putting the foxes in charge of the henhouse. Individuals whose professional success is inextricably linked to the continued hype of cryptocurrency will now advise the state on how to spend taxpayer money to… buy more cryptocurrency. The conflicts of interest are glaring.

This decision isn’t a savvy financial move; it’s a political statement. It’s an attempt to brand Texas as “crypto-friendly,” chasing a trend that has all the hallmarks of past manias, from tulips to dot-com stocks. While private companies and individuals are free to gamble their own money, it is profoundly irresponsible for a government to do so with public funds. When this speculative fever breaks, and it will, it won’t be the politicians or their crypto advisors who are left holding the bag. It will be the citizens of Texas, whose money was used to purchase digital nothingness.