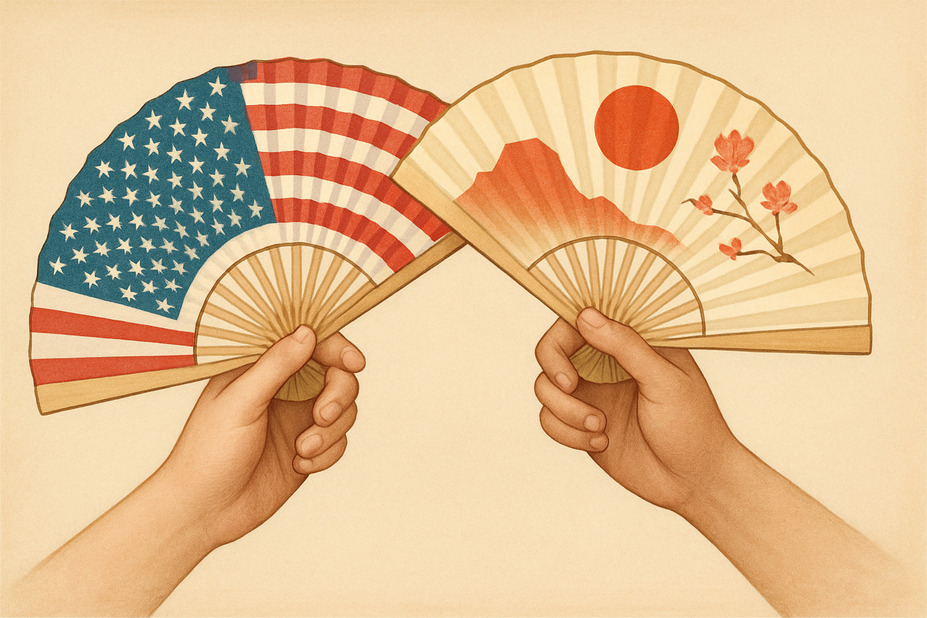

Stablecoin showdown: Is a new US-China financial race underway?

Stablecoins, a type of cryptocurrency designed to hold a steady value, are emerging as a new battleground between China and the United States, potentially reshaping the future of global finance.

As both Hong Kong and Washington roll out new laws to regulate stablecoins, a race is on to establish dominance in this emerging sector. Hong Kong is aiming to reclaim its position as a global financial hub by fostering a stablecoin and Web3 ecosystem. Meanwhile, in the US, the Trump administration, buoyed by support from the “crypto bros,” is also making a major push into cryptocurrencies.

These developments could have major implications for both economies, and the wider world of finance.

Hong Kong: a stablecoin launchpad

Hong Kong’s new Stablecoins Bill, passed in May, aims to create a comprehensive regulatory framework for stablecoins pegged to traditional currencies. This move is seen as part of Beijing’s broader strategy to create an alternative to the US-dominated global financial order. Alongside initiatives like the Cross-Border Interbank Payment System (CIPS), BRICS Pay, the digital renminbi, and increased use of the renminbi in international transactions, Hong Kong’s stablecoins offer another avenue for China to conduct international trade outside of the US dollar’s sphere of influence.

While mainland China heavily restricts cryptocurrencies like Bitcoin, Hong Kong has been given the green light to enter the stablecoin market. After the 2019 protests and the COVID-19 pandemic, the Chinese government is keen to restore Hong Kong’s status as a global financial hub. The stablecoins bill is part of this effort, intended to attract foreign banking organizations back to the city. Hong Kong will once again become a gateway for China, this time for Web3 and cryptocurrencies, allowing China to participate in international trade involving these technologies while keeping the mainland market insulated from their volatility.

America: land of the crypto bros?

In the US, Trump recently signed the Guiding and Establishing National Innovation for US Stablecoins Act (GENIUS Act) into law. This bill also aims to create a “comprehensive regulatory framework” for stablecoins, requiring them to be pegged to the US dollar or other low-risk assets, registered with regulators, and subject to audits. The GENIUS Act is intended to maintain the dominance of the US dollar in the growing digital payments landscape, as stablecoins pegged to the US dollar are already gaining traction as a form of payment.

However, questions remain about whether the US embrace of stablecoins is truly driven by national interests or by the interests of Trump and his allies. Crypto investors and executives, who heavily supported Trump’s 2024 campaign, are hoping that the GENIUS Act will lead to favorable legislation for the cryptocurrency industry.

Concerns have also been raised by Trump’s involvement with meme coins. For example, his “$Trump” meme coin saw significant price fluctuations shortly after its launch, raising questions about potential “rug pulls” where developers abandon a coin after making initial profits.

As digital currencies become more regulated and stable, their integration into the global financial system is likely to increase, with stablecoins representing another step in this direction. However, the risks associated with crypto remain a concern.