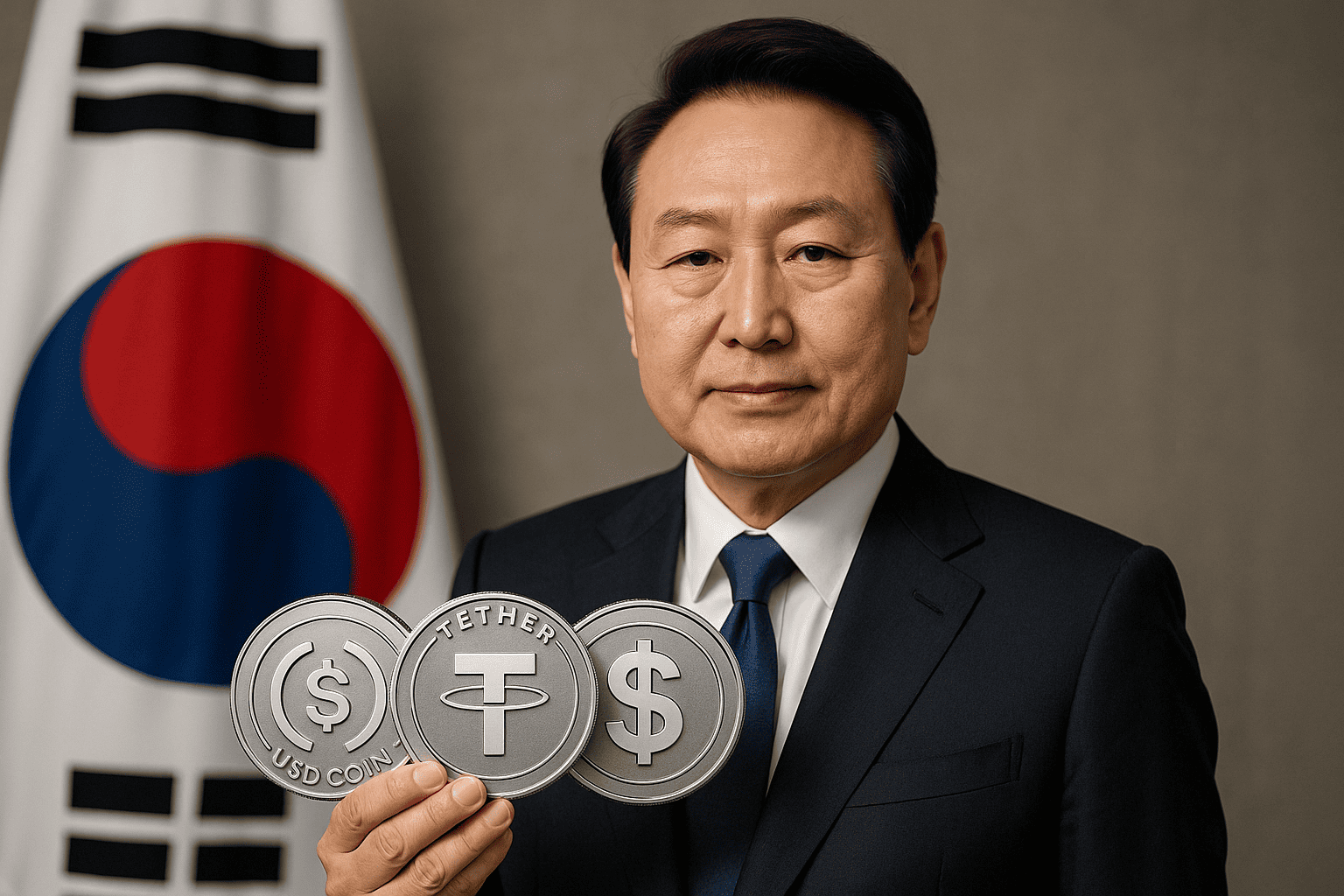

South Korea’s ruling party has announced a plan to issue stablecoins in the country

The newly elected head of state, Lee Jae-myung, is actively working on one of his key campaign messages. He wants to legalise the issuance of stable coins by local companies.This change is intended to boost the growth of one of the fastest-growing digital asset markets worldwide.

Mr Lee, who is known for his progressive views and defeated a conservative opponent in the recent presidential election, has consistently advocated for the integration of stablecoins into the economy.

On Tuesday, the Democratic Party, led by Lee, presented a new plan called the ‘Basic Digital Assets Act’.The document aims to enhance transparency in operations and promote a competitive environment in the cryptocurrency sector. The rules say that South Korean businesses can issue stable coins if they have at least 500 million won (about $367,876) and can recover funds by setting up a reserve fund.

South Korea is already an important place for cryptocurrency activity. A lot of people, more than a third of the population, about 18 million citizens, are dealing with digital assets.Sometimes, the number of transactions on local cryptocurrency exchanges is higher than the combined turnover of the Kospi and Kosdaq national stock indices.

Stablecoins are a type of cryptocurrency. The value of stablecoins is linked to another asset. Most often this is the US dollar. More and more people around the world are using them as the rules about how they work are being decided. On Wednesday, Congress in the United States is going to vote on an important bill about stable coins. The former President Donald Trump has already said that this area is one of the most important areas for the government to focus on.

According to the text of the bill released by the ruling party, South Korean law would also require digital assets backed by other assets, including stablecoins, to undergo an approval process at the Financial Services Commission.

Stablecoin market in South Korea demonstrates active growth. According to the Yonhap news agency, referring to the Bank of Korea’s statistics, in the first quarter of this year the volume of transactions with USDT, USDC and USDS on the five leading domestic exchanges reached 57 trillion won.

However, the country’s central bank has expressed some concerns about President Lee’s plan.The governor of the Bank of Korea, Ri Chang-yong, last month expressed concerns that stablecoins issued by non-banks could weaken the effectiveness of monetary policy instruments. He suggested that the central bank should take the lead in regulating stable coins linked to the Korean won.

These processes are also being closely followed by the global financial community. Leading technology corporations and major banking institutions, such as Deutsche Bank and Santander, are considering the prospect of issuing their own stablecoins.

Since its IPO last week, shares in Circle, the world’s second-largest stablecoin issuer, have seen significant gains.

South Korea’s steps in this direction are fuelling share prices of local companies related to the digital asset industry. KakaoPay Corp. shares rose 18 per cent on Tuesday, the biggest rise since January 2024, amid expectations that the Lee administration will support Korean won-based stablecoin projects.

Even though most people are feeling hopeful, some experts are not as optimistic. Analysts at JPMorgan, Stanley Yang and Jihyun Cho, said in a research note that the rise in the shares of Kakao-affiliated companies doesn’t have a solid reason, as the specific benefits that may come from Lee’s stablecoin policy are not clear.

South Korea is still feeling the effects of the collapse of the TerraUSD project in 2022. This project lost $40 billion. The incident serves as an important cautionary tale for a country that is once again stepping up efforts to integrate stablecoins into its financial system.