FDUSD: A New Stablecoin Contender Navigates a Crowded Market

Hong Kong-based firm enters the stablecoin arena with reserve-backed offering

Launched in June 2023, First Digital USD (FDUSD) emerged as a reserve-backed stablecoin, backed by First Digital Limited, a financial services firm based in Hong Kong. This move places them amidst an increasingly competitive landscape of digital currencies vying for dominance. Currently operating on the Ethereum and BNB Chain networks, FDUSD’s initial focus is on well-established blockchain ecosystems. However, the company has expressed intentions to expand its reach by integrating with other blockchain platforms in the future, indicating a long-term vision for growth and wider adoption.

Transparency is a key aspect of the FDUSD approach. The company regularly issues reserve audit reports.These reports, conducted by independent auditors, aim to provide assurance to users by claiming full backing by cash or equivalent financial instruments. This emphasis on transparency is crucial for building trust in the volatile world of cryptocurrencies, where concerns about stability and security often deter potential adopters.

The Mechanics of Stability: How FDUSD Aims to Maintain its Peg

Taking a look at FD121 Limited and the role of First Digital Trust Limited.

FDUSD is officially issued by FD121 Limited, a subsidiary of First Digital Limited, underscoring the structured corporate backing behind this digital asset. A core element of FDUSD’s design is its commitment to stability, with the company aiming to maintain a one-to-one peg with the US dollar. This is achieved by holding US dollar or equivalent reserves, managed by a designated custodian, First Digital Trust Limited.

First Digital Trust Limited plays a vital role in safeguarding the reserves as a trustee operating under Hong Kong’s regulatory framework. Crucially, the regulations stipulate that these reserves must be held in separate accounts, thereby preventing them from being mixed with the firm’s other assets.This separation of funds is designed to protect the interests of FDUSD holders in the event of unforeseen circumstances.

Furthermore, First Digital Trust Limited is required to maintain these reserves in highly liquid forms, further ensuring the stability and redeemability of the FDUSD stablecoin. This commitment to liquidity aims to guarantee that FDUSD holders can reliably convert their tokens back to US dollars or equivalent assets on demand. The collateralisation process is regularly audited and verified independently, further reinforcing this entire mechanism.

Navigating a Sea of Stablecoins: What Makes FDUSD Different?

Analyzing FDUSD’s Potential in a Crowded Market

The cryptocurrency market is currently flooded with stablecoins, all competing for attention and adoption. Against this backdrop, FDUSD emerges with a clear objective: to offer users greater diversification options.The company understands that investors who want to manage risk and explore different opportunities in the digital asset space will find it useful to have a variety of stablecoins to choose from.

By offering a new stablecoin option, FDUSD aims to contribute to a more robust and diverse ecosystem. Its commitment to transparency, regulatory compliance, and sound reserve management are intended to differentiate it from other players in the market. However, the long-term success of FDUSD will ultimately depend on its ability to attract users, build partnerships, and navigate the evolving regulatory landscape.

Stablecoins: Essential Building Blocks of the Digital Economy

Exploring the Advantages and Applications of FDUSD

Stablecoins like FDUSD are quickly becoming a very important part of the modern digital economy. They offer a unique combination of the benefits of cryptocurrencies, such as speed and efficiency, with the stability and predictability of traditional fiat currencies. This makes them good for all sorts of uses, from everyday transactions to complicated financial operations.

One of the key advantages of stablecoins is their ability to facilitate faster and lower-cost transactions compared to traditional methods. By operating on blockchain networks, they can bypass the inefficiencies and intermediaries that often plague traditional payment systems. This is particularly beneficial for cross-border transactions, where fees and processing times can be significantly reduced.

Stablecoins are also safer and more private than traditional financial instruments. They make it more secure and transparent by using cryptography. This is especially good for people and companies that are worried about data breaches and privacy violations.

FDUSD, in particular, aims to capitalize on these advantages, providing a reliable and efficient tool for various applications within the digital economy.

The Practical Applications of FDUSD: From Payments to DeFi

Exploring the Versatility of FDUSD in the Digital Realm

FDUSD is useful for lots of different applications, so it is a valuable tool for individuals, businesses, and developers. In the realm of international transfers, FDUSD enables fast and cost-effective transactions, representing a significant improvement over traditional banking systems. This is especially useful for money transfer services, like those used by people sending money home or businesses trading abroad. The lower fees and faster transactions can save you a lot of money and make things more efficient.

Beyond international transfers, FDUSD is also poised to transform payment systems for both businesses and individuals. The ability to conduct transactions with reduced costs and accelerated processing makes it an attractive alternative to traditional payment methods, especially in international scenarios where currency conversion fees and international transfer charges can be substantial.

FDUSD’s role extends beyond simple payments; it is also emerging as a valuable tool for managing risk in volatile cryptocurrency markets. Investors can utilize FDUSD to hedge against market fluctuations by converting their assets into a stable store of value during periods of uncertainty. This ability to mitigate risk makes FDUSD an essential component of any well-diversified cryptocurrency portfolio.

Furthermore, FDUSD is making inroads into the rapidly evolving world of Decentralized Finance (DeFi). Its integration into DeFi platforms facilitates a range of activities, including yield farming, lending, and staking, enabling users to earn passive income on their holdings. FDUSD’s growing presence in the DeFi space is making it more useful and strengthening its role in the wider cryptocurrency world.

Understanding the risks: A close look at FDUSD’s weak points

Addressing the Potential Pitfalls of Investing in FDUSD

While FDUSD offers a range of compelling benefits, it is crucial to acknowledge and understand the potential risks associated with its use. One of the most significant risks is the potential for losing its peg to the US dollar. The stability of FDUSD hinges on the ability of its reserves to ensure redemption on demand. If these reserves are compromised or insufficient, the value of FDUSD could deviate from its intended peg, leading to potential losses for holders.

The composition of the reserves themselves is another factor to consider. If a significant portion of the reserves is held in less liquid assets, it could become challenging to meet redemption requests during periods of high demand. This could further exacerbate the risk of losing the peg.

Beyond the reserves, FDUSD is also subject to operational risks. These risks include the potential for cyber threats, fraud, and other disruptions that could compromise the integrity of the platform and the safety of user funds. Since FDUSD relies on third-party service providers like exchanges and custodial solutions, it is also exposed to the risks associated with those entities. Any vulnerabilities or failures within these third-party systems could have a direct impact on FDUSD holders.

It is essential for users to carefully assess these risks and understand the potential downsides before investing in or using FDUSD.

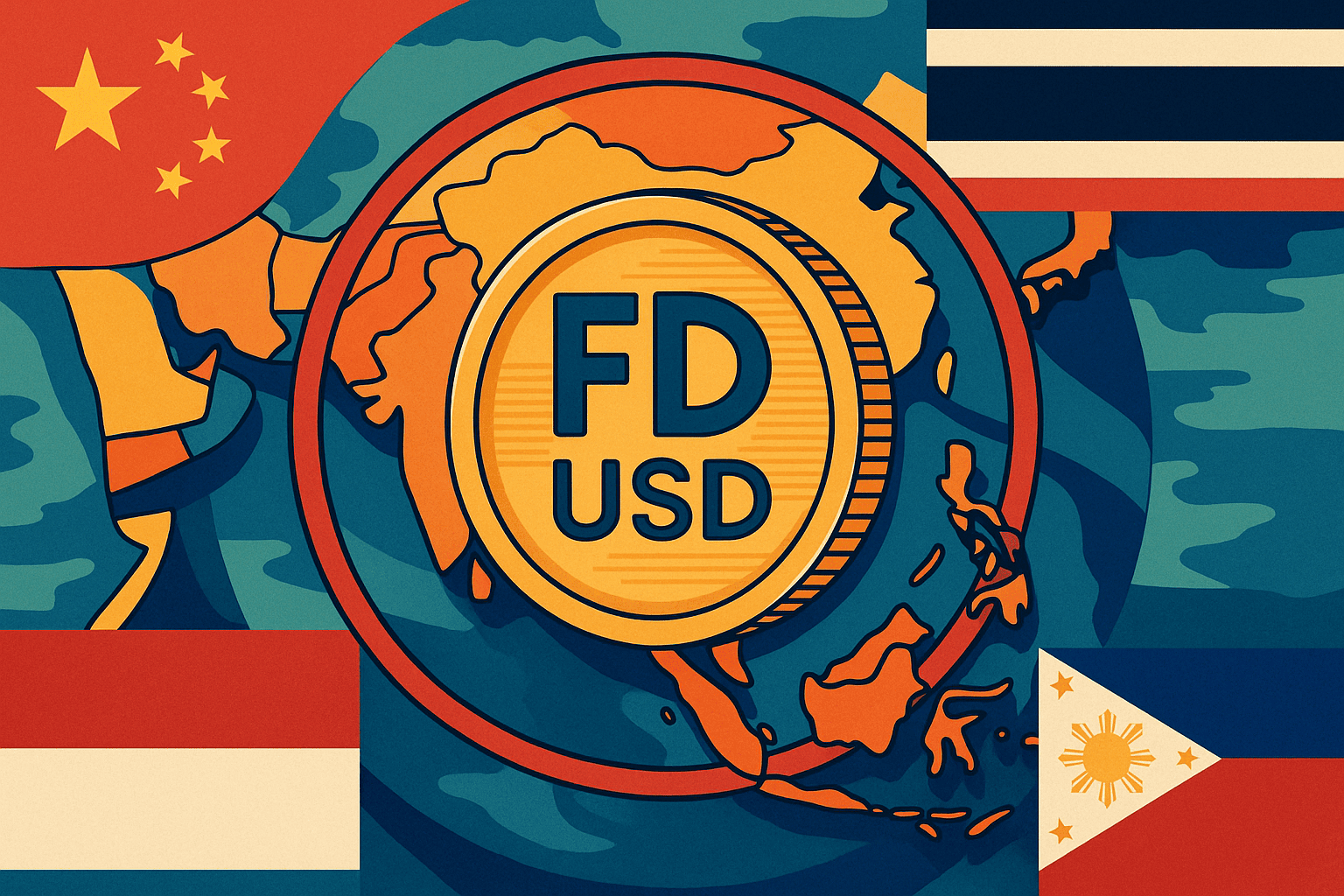

FDUSD’s Asian Ascent: A Region Embracing Stablecoin Solutions

Examining the Growing Popularity of FDUSD in Asia

In recent times, FDUSD has experienced a surge in popularity in Asia. The region’s increasing digital literacy and strong interest in digital currency have positioned FDUSD to be a reliable alternative in the face of traditional financial difficulties.

This surge in popularity can be attributed to several factors. Asia is at the forefront of digitalization, with many countries rapidly adopting new technologies and embracing digital solutions. This creates a favorable environment for the adoption of stablecoins like FDUSD, which offer a convenient and efficient way to transact in the digital world.

Additionally, there is a growing interest in cryptocurrency assets across Asia, particularly as alternative investment vehicles. Many individuals and businesses are seeking to diversify their portfolios and explore new opportunities in the digital asset space. Stablecoins like FDUSD provide a relatively stable and accessible entry point into the world of cryptocurrencies.

The relevance and progress of stablecoins, including FDUSD, highlight their growing significance in Asian financial systems, providing solid resources in the face of conventional financial limitations.

The Future of Stablecoins: A Trillion-Dollar Market on the Horizon?

Analysts Predict Continued Growth and Expansion in the Stablecoin Sector

Experts predict that the stablecoin market is poised for significant growth in the coming years. In the next five years, the industry is projected to reach one trillion dollars. FDUSD is one of the newest competitors in the stablecoin sector, which is growing rapidly.

The continuous popularity of digital currencies and the active growth of ventures in both the crypto and conventional financial sectors underscore the need for specialized stablecoins tailored to distinct functions. This growing demand translates to an expanded range of possibilities for consumers in search of suitable options.

While stablecoins, like FDUSD, present benefits, they also carry inherent risks. It is critical for customers to carefully examine information before committing to a digital currency.

In conclusion, the future success of FDUSD will depend on its ability to overcome its challenges, seize opportunities, and build a strong foundation for long-term growth.