Bitcoin bounces back above $115,000 after wild weekend!

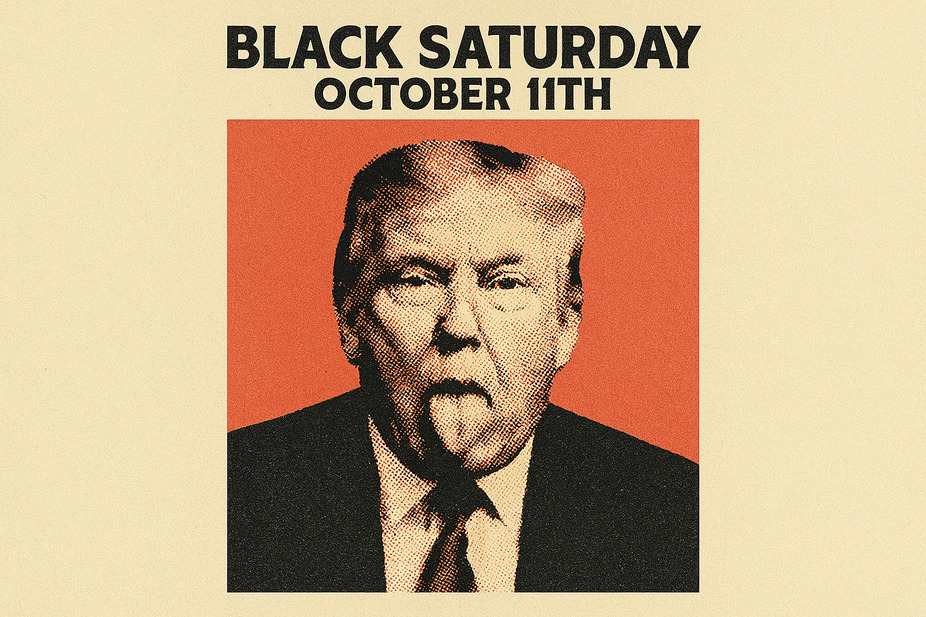

Good news for crypto fans! After a pretty brutal dip on October 11th, the price of Bitcoin – often called “digital gold” – has made a solid comeback. It’s now trading comfortably above the $115,000 mark.

What caused that sudden drop? Well, according to Rick Maeda, an analyst with Presto Research at The Block, it wasn’t really anything internal to the crypto market itself. Instead, he believes it was driven by bigger macroeconomic news.

Right now, Bitcoin’s price has climbed about 3.2% in the last 24 hours, settling around $115,400. Ethereum, not to be outdone, saw an even bigger jump, soaring 9% to about $4,190, according to CoinGecko.

Maeda pins the blame for the crash on news concerning China’s export restrictions and the US’s counter-plans to slap 100% tariffs on tech imports. He suggests that this bad news hit over a weekend when trading liquidity is typically low, which then triggered a massive wave of forced liquidations, totaling billions of dollars.

And “massive” is an understatement. CoinGlass reported that on October 11th alone, over 1.6 million traders saw their positions closed out, adding up to a mind-boggling $19.1 billion in liquidations. This was truly a record-breaking event in crypto history.

What’s next for “Uptober”?

So, after that gut-wrenching dip and quick rebound, what does it mean for the much-anticipated “Uptober” – the idea that October is traditionally a strong month for crypto gains? Analysts are a bit split.

Vincent Liu, the Chief Investment Officer at Kronos Research, is feeling optimistic. He thinks that people’s willingness to take on risk is back, and the “Uptober” trend is still very much alive. Nassar Achkar, CoinW’s Chief Strategy Officer, agrees, adding that traders are now keenly watching key economic indicators like the US inflation report, the upcoming Federal Reserve meeting, and any new money flowing into spot Bitcoin ETFs.

Nick Rak, Director at LVRG Research, points to on-chain data for Ethereum, noting that “whales” (large holders) were accumulating ETH during the dip, which helped support the rebound.

However, Maeda, the analyst from The Block, is a bit more cautious. He believes that while the upward trend hasn’t been completely “derailed,” it definitely took a hit. He warns that the record-breaking liquidations could leave a “heavy burden” on market participants, making them much more sensitive to any future news about trade disputes between the US and China.

The Kobeissi Letter, a financial newsletter, also weighed in, suggesting that this crypto crash won’t have long-term fundamental consequences. They attribute it more to a mix of technical factors rather than anything deeply wrong with crypto itself.

Essentially, Bitcoin has shown its resilience, bouncing back quickly. But everyone is now watching the global economic stage and trade relations very closely, as these seem to be the major drivers for crypto’s next move.